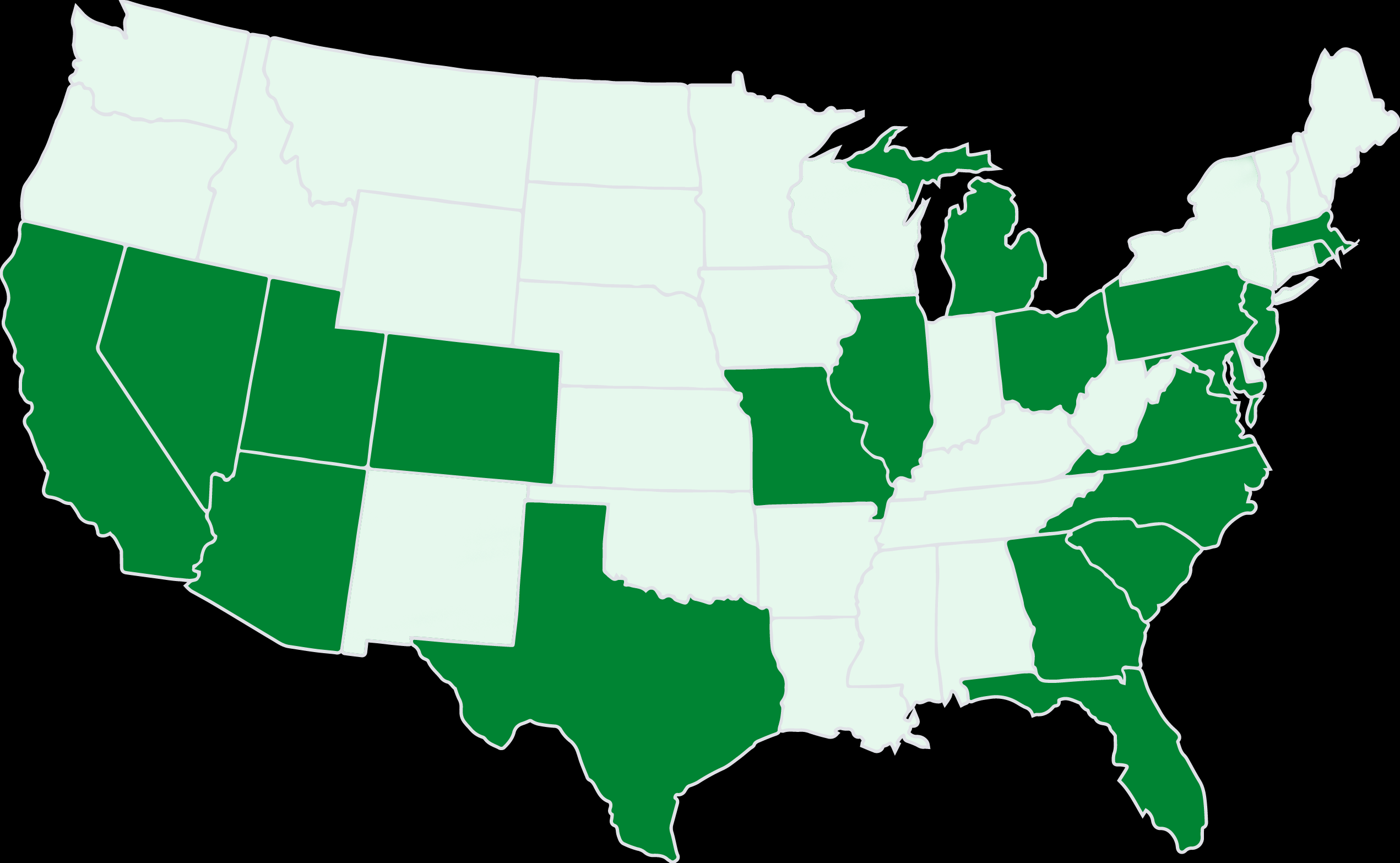

Home solar incentives are often changing state by state. The content listed below may or may not be active at the time you are researching for your project. Please ensure you reach out to state representatives to ensure the most up to date list of benefits. Many other States offer additional benefits, however we have generated the list below based on the States we cover. If you like what you see and want to know more. Please contact us!

Our list of home solar incentives by state:

Arizona

Arizona is known for its abundant sunshine, and there are several incentives available to homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- Arizona State Tax Credit: Arizona homeowners can receive a state tax credit equal to 25% of the cost of their solar system, up to a maximum of $1,000.

- Net Metering: Arizona utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Property Tax Exemption: In Arizona, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Sales Tax Exemption: Solar equipment and installation are exempt from state sales taxes in Arizona, which can also result in significant savings for homeowners.

- Arizona Public Service (APS) Solar Purchase Program: The APS Solar Purchase Program allows homeowners to receive a fixed monthly payment for excess solar energy that they generate and send back to the grid.

California

California is a leader in promoting renewable energy and has several incentives available to homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 26% of the cost of their solar system. This credit is set to expire at the end of 2023, so homeowners are encouraged to act quickly.

- California Solar Initiative (CSI) Rebate Program: The CSI Rebate Program provides rebates to homeowners who install solar panels on their homes. The rebate amount varies depending on the size of the system and the utility, but it can be up to $0.25 per watt.

- Net Metering: California utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Property Tax Exemption: In California, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Sales Tax Exemption: Solar equipment and installation are exempt from state sales taxes in California, which can also result in significant savings for homeowners.

- California Self-Generation Incentive Program (SGIP): The SGIP provides incentives for homeowners who install solar panels and other forms of distributed generation. The program offers rebates on a first-come, first-served basis, and the rebate amount depends on the size of the system and the utility.

- California Alternative Rates for Energy (CARE) Program: The CARE Program provides a discounted rate on electricity for low-income households, which can help make solar energy more affordable.

Colorado

Colorado offers several incentives for homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- Colorado Renewable Energy Property Tax Exemption: In Colorado, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Net Metering: Colorado utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Solar Rebates: The Colorado Solar Rebate Program provides rebates to homeowners who install solar panels on their homes. The rebate amount varies depending on the size of the system, but it can be up to $1.50 per watt, with a maximum rebate of $3,000.

- Solar Access Rights: In Colorado, homeowners are protected by law and have the right to install solar panels on their homes, as long as they comply with local building codes and homeowner association rules.

- Community Solar Gardens: Colorado offers a Community Solar Gardens program, which allows homeowners to purchase or lease a share of a larger solar array and receive credit on their electric bills for the energy produced by their share.

Florida

Florida has been slow to adopt solar energy, but there are still some incentives available to homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- Florida Property Tax Exemption for Renewable Energy Property: In Florida, solar panels and other renewable energy systems are exempt from property taxes, which can result in significant savings for homeowners.

- Net Metering: Florida utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Solar Rebates: Some Florida utilities offer rebates to homeowners who install solar panels on their homes. The rebate amount varies depending on the utility, but it can be up to $2,000.

- Sales Tax Exemption: Solar equipment and installation are exempt from state sales taxes in Florida, which can also result in significant savings for homeowners.

Georgia

Georgia has several incentives available to homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 26% of the cost of their solar system. This credit is set to expire at the end of 2023, so homeowners are encouraged to act quickly.

- Georgia Solar Easements: In Georgia, homeowners have the right to enter into solar easement agreements with their neighbors or other parties to ensure that their solar access is protected. This can help ensure that homeowners can continue to generate solar energy without obstruction from trees, buildings, or other structures.

- Solar Rebates: Some Georgia utilities offer rebates to homeowners who install solar panels on their homes. The rebate amount varies depending on the utility, but it can be up to $450 per kW.

- Property Tax Exemption: In Georgia, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Sales Tax Exemption: Solar equipment and installation are exempt from state sales taxes in Georgia, which can also result in significant savings for homeowners.

- Net Metering: Georgia utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

Illinois

Illinois offers several incentives for homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Illinois Solar Renewable Energy Credits (SRECs): Homeowners who install solar panels can earn SRECs, which represent the environmental benefits of the solar energy that they generate. These credits can be sold on a market, providing homeowners with additional income.

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- Property Tax Exemption: In Illinois, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Solar Rebates: Some Illinois utilities offer rebates to homeowners who install solar panels on their homes. The rebate amount varies depending on the utility, but it can be up to $1,000 per kW.

- Net Metering: Illinois utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Solar Renewable Energy Certificates (REC): Illinois utility companies are required to generate a certain amount of renewable energy, and they can purchase RECs from homeowners who generate solar energy to help meet this requirement. This provides homeowners with additional income.

Maryland

Maryland offers several incentives for homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Maryland Solar Renewable Energy Credits (SRECs): Homeowners who install solar panels can earn SRECs, which represent the environmental benefits of the solar energy that they generate. These credits can be sold on a market, providing homeowners with additional income.

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- Property Tax Exemption: In Maryland, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Solar Rebates: Some Maryland utilities offer rebates to homeowners who install solar panels on their homes. The rebate amount varies depending on the utility, but it can be up to $1,000 per kW.

- Net Metering: Maryland utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Solar Water Heating: Maryland also offers a tax credit for homeowners who install solar water heating systems. This credit is equal to 26% of the installed cost of the system, up to $5,000.

Massachusetts

Massachusetts has several incentives available to homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Massachusetts Solar Renewable Energy Credits (SRECs): Homeowners who install solar panels can earn SRECs, which represent the environmental benefits of the solar energy that they generate. These credits can be sold on a market, providing homeowners with additional income.

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- Property Tax Exemption: In Massachusetts, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Solar Rebates: Some Massachusetts utilities offer rebates to homeowners who install solar panels on their homes. The rebate amount varies depending on the utility, but it can be up to $1,000 per kW.

- Net Metering: Massachusetts utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Solar Loan Program: The Massachusetts Clean Energy Center offers a low-interest loan program for homeowners who want to install solar panels on their homes.

- Solar Massachusetts Renewable Target (SMART) Program: The SMART program provides incentives for solar projects up to 5 MW in size. The program is designed to encourage the development of solar energy projects in the state.

Michigan

Michigan has several incentives available to homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- Property Tax Exemption: In Michigan, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Net Metering: Michigan utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Solar Rebates: Some Michigan utilities offer rebates to homeowners who install solar panels on their homes. The rebate amount varies depending on the utility, but it can be up to $500 per kW.

- PACE Financing: Michigan also offers Property Assessed Clean Energy (PACE) financing, which allows homeowners to finance their solar panels through their property taxes. This program provides low-interest loans with no upfront costs.

- Solar Power Purchase Agreements (PPAs): Some Michigan solar companies offer solar PPAs, which allow homeowners to install solar panels on their homes with no upfront costs. Instead, homeowners pay a fixed rate for the solar energy that they use, which is often lower than their current utility rate.

Missouri

Missouri offers several incentives for homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- Property Tax Exemption: In Missouri, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Net Metering: Missouri utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Solar Rebates: Some Missouri utilities offer rebates to homeowners who install solar panels on their homes. The rebate amount varies depending on the utility, but it can be up to $500 per kW.

- Low-Interest Loans: The Missouri Department of Natural Resources offers low-interest loans to homeowners who want to install solar panels on their homes. These loans have an interest rate of 3.99% and can be used to cover up to 100% of the installation cost.

- Solar Power Purchase Agreements (PPAs): Some Missouri solar companies offer solar PPAs, which allow homeowners to install solar panels on their homes with no upfront costs. Instead, homeowners pay a fixed rate for the solar energy that they use, which is often lower than their current utility rate.

Nevada

Nevada offers several incentives for homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- Net Energy Metering: Nevada utilities offer net energy metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Solar Water Heating Rebates: The state of Nevada offers rebates to homeowners who install solar water heating systems. The rebate amount varies depending on the size of the system, but it can be up to $1,500.

- Sales Tax Exemption: In Nevada, solar panels are exempt from state sales tax, which can result in significant savings for homeowners.

- Property Tax Abatement: Some Nevada counties offer property tax abatement for homeowners who install solar panels on their homes. This means that the value of the solar system is not included in the property value assessment for tax purposes.

- Solar Lease and Power Purchase Agreements (PPAs): Some Nevada solar companies offer solar leases and PPAs, which allow homeowners to install solar panels on their homes with no upfront costs. Instead, homeowners pay a fixed rate for the solar energy that they use, which is often lower than their current utility rate.

New Jersey

New Jersey offers several incentives for homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- State Rebates: The state of New Jersey offers rebates to homeowners who install solar panels on their homes. The rebate amount varies depending on the size of the system, but it can be up to $5,000.

- Property Tax Exemption: In New Jersey, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Net Metering: New Jersey utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Solar Renewable Energy Credits (SRECs): New Jersey operates a solar renewable energy credit program, which allows homeowners to earn credits for the solar energy that they produce. These credits can be sold to utilities to help them meet their renewable energy requirements.

- Low-Interest Loans: The state of New Jersey offers low-interest loans to homeowners who want to install solar panels on their homes. These loans have an interest rate of 2.99% and can be used to cover up to 100% of the installation cost.

North Carolina

North Carolina offers several incentives for homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- State Tax Credits: North Carolina offers a state tax credit for renewable energy projects, including solar panel installations. The credit is worth 35% of the total installed cost of the system, up to a maximum of $10,500.

- Net Metering: North Carolina utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Property Tax Exemption: In North Carolina, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Sales Tax Exemption: The state of North Carolina offers a sales tax exemption for solar panel installations, which can help reduce the upfront costs of the system.

- Solar Rebates: Some North Carolina utilities offer rebates for solar panel installations. The amount of the rebate varies by utility, but it can be up to several thousand dollars.

Ohio

Ohio does not currently have any state-level incentives specifically for homeowners who install solar panels on their homes. However, there are still some options for homeowners to save money on their solar installations.

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- Net Metering: Ohio utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Property Tax Exemption: In Ohio, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Sales Tax Exemption: The state of Ohio offers a sales tax exemption for solar panel installations, which can help reduce the upfront costs of the system.

- Solar Incentives from Utilities: Some Ohio utilities offer incentives for solar panel installations. The amount of the incentive varies by utility, but it can be up to several thousand dollars.

Pennsylvania

Pennsylvania offers several incentives for homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- State Tax Credits: Pennsylvania offers a state tax credit for renewable energy projects, including solar panel installations. The credit is worth 15% of the total installed cost of the system, up to a maximum of $7,500.

- Net Metering: Pennsylvania utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Solar Renewable Energy Credits (SRECs): Pennsylvania participates in a regional program called the PJM Interconnection, which allows homeowners to earn SRECs for the solar energy they generate. SRECs can be sold on a market, providing homeowners with an additional revenue stream.

- Property Tax Exemption: In Pennsylvania, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Sales Tax Exemption: The state of Pennsylvania offers a sales tax exemption for solar panel installations, which can help reduce the upfront costs of the system.

Rhode Island

Rhode Island offers several incentives for homeowners who install solar panels on their homes. Some of the most notable incentives include:

- State Renewable Energy Growth Program (RE Growth Program): The RE Growth Program offers incentives to homeowners who install solar panels on their homes, including a performance-based incentive (PBI) that pays homeowners for every kilowatt-hour (kWh) of solar energy they produce. The PBI rate varies depending on the size of the system and other factors.

- Net Metering: Rhode Island utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Sales Tax Exemption: The state of Rhode Island offers a sales tax exemption for solar panel installations, which can help reduce the upfront costs of the system.

- Property Tax Exemption: In Rhode Island, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Solarize Rhode Island: Solarize Rhode Island is a program that helps homeowners and businesses install solar panels by offering group purchasing discounts, free solar site assessments, and access to financing options.

- Rhode Island Renewable Energy Fund: The Rhode Island Renewable Energy Fund offers grants and loans for renewable energy projects, including solar panel installations. The program is administered by the Rhode Island Office of Energy Resources.

South Carolina

There are several incentives available to homeowners in South Carolina who are interested in installing solar panels on their homes. Some of the most notable incentives include:

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- South Carolina State Solar Tax Credit: Homeowners who install solar panels can receive a state tax credit equal to 25% of the cost of their solar system, up to a maximum of $3,500.

- Net Metering: South Carolina utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Property Tax Exemption: In South Carolina, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Sales Tax Exemption: Solar equipment and installation are exempt from state and local sales taxes in South Carolina, which can also result in significant savings for homeowners.

Texas

Texas offers several incentives for homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- Texas Solar Rebates: The Texas Solar Rebate Program provides rebates to homeowners who install solar panels on their homes. The rebate amount varies depending on the size of the system, but it can be up to $0.85 per watt, with a maximum rebate of $17,500.

- Property Tax Exemption: In Texas, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Sales Tax Exemption: Solar equipment and installation are exempt from state sales taxes in Texas, which can also result in significant savings for homeowners.

- Net Metering: Many Texas utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

Utah

Utah offers several incentives for homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Federal Solar Investment Tax Credit (ITC): Homeowners who install solar panels can receive a federal tax credit equal to 30% of the cost of their solar system. This credit is set to expire at the end of 2030.

- State Tax Credits: Utah offers a state tax credit for renewable energy projects, including solar panel installations. The credit is worth 25% of the total installed cost of the system, up to a maximum of $1,600 for residential installations.

- Net Metering: Utah utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Solar Rights: Utah law protects homeowners’ rights to install solar panels on their property and to connect their systems to the grid. This protection includes the right to install solar panels on a roof or on the ground, as long as they meet certain requirements.

- Property Tax Exemption: In Utah, solar panels are exempt from property taxes, which can result in significant savings for homeowners.

- Solar Access Rights: Utah law also provides for solar access rights, which protect homeowners’ ability to receive sunlight on their solar panels. This protection includes the right to remove trees or other structures that may block sunlight to the panels.

Virginia

Virginia offers several incentives for homeowners who install solar panels on their homes. Some of the most notable incentives include:

- Net Metering: Virginia utilities offer net metering, which allows homeowners to receive credits on their electric bills for excess solar energy that they generate and send back to the grid.

- Solarize Virginia: Solarize Virginia is a program that helps homeowners and businesses install solar panels by offering group purchasing discounts, free solar site assessments, and access to financing options.

- Tax Credits: Virginia offers a tax credit for renewable energy projects, including solar panel installations. The credit is worth 26% of the total installed cost of the system, up to a maximum of $5,000 for residential installations.

- Sales Tax Exemption: The state of Virginia offers a sales tax exemption for solar panel installations, which can help reduce the upfront costs of the system.

- Virginia Solar Energy Development and Energy Storage Authority: The Virginia Solar Energy Development and Energy Storage Authority is a state agency that offers grants and loans for renewable energy projects, including solar panel installations. The program is administered by the Virginia Department of Mines, Minerals, and Energy.

To learn more about home solar incentives by State, we recommend you look here.